Motorcycle Customers may become first time car buyers in developing markets, but you do not study combined demand for Motorcycles and Passenger cars. Or should you? Sales data from various markets show that Motorcycle Sales and Passenger Car Sales grow (or lose) in tandem and that there is a very high correlation between the two!

Estimating medium term demand (for keeping availability and delivery promises) for passenger cars is tricky and perhaps futile. There could be hundreds of exogenous factors that can be force plot to establish a degree of ‘linear’ correlation but in reality, there were other causal factors at work. A first-time car buyer is much unalike a second time car buyer who may want to own his premium SUV or MUV. But unlike firms that sell potato chips and ice creams, the good thing about automobile industry is about availability of quality granular historical data on sales from a variety of sources. Regional Transport Office, Manufacturers own data. SIAM, Ministry of Industry and Dept of Statistics, Market Research firms like AC Nielsen and other independent insights providers like www.statista.com. Yet predicting sales of individual models on a monthly basis seem very hard. They are wrong by a huge margin.

There is very limited shallow academic literature in this area. Some ‘research’ published out there is about testing existing modified time series and ‘simplistic’ regression models with no rigor .

Here the entire risk of bad forecast is borne usually by dealers who are forced to sell old model years inventory at almost throwaway prices. Not the OEM’s problem. (Though the only reason dealers have to forecast is for maintaining reordering levels and buffering for lead time (un)certainties of both buy and sell side

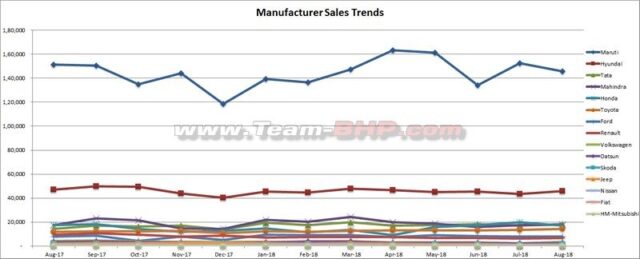

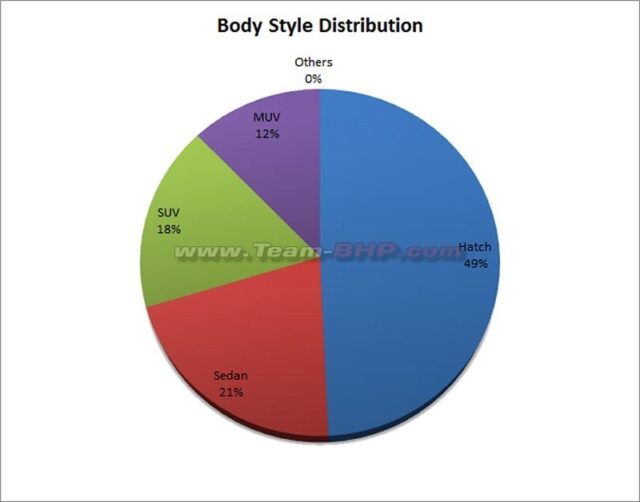

While at a ‘segment’ level aggregate demand itself may be smooth and predictable (as in the case of Indian Markets with two minor dips in a year and more or less level rest of the year), estimating sales for individual auto brands-models is about predicting market share shifts and segment shifts.

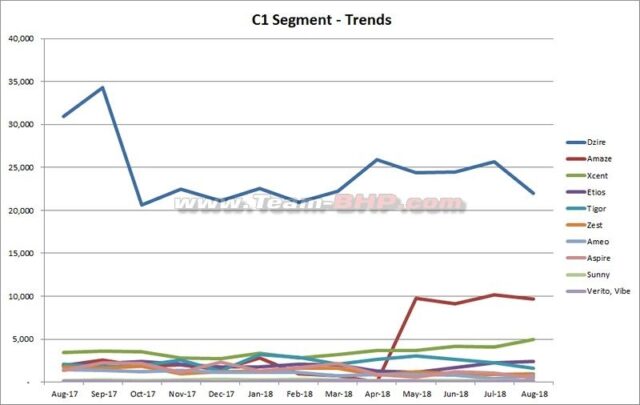

These graphs below reveal quite some easy to grasp information on Indian Passenger Car Markets. (Calendar year and financial year dips for reasons of model year impacting resale price and depreciation tax shield resp)

Source: www.team-bhp.com

Despite stiff competition from almost all known auto makers on earth, Maruti Suzuki acquired more than 50% market share from its competition through ingenious marketing. It got all the after sales niceties that others do not seem to match or perhaps not interested to offer. Used cars buyback value assurance, extended warranties at a ‘nominal’ cost, attractive refinance costs, low cost of service etc. While customers may have a desire to buy a Honda or VW, they end up buying (the not so good looking) DZire that sold more units than all of competition between 2015 and 2018. A keen analyst can spot capacity insufficiency at Maruti costing them lost sales of about 25% in the year 2017. Honda Amaze was well timed and managed to make a big dent to DZire for a while and then it fizzled out. Honda delivered in under 2 weeks. DZire had a waiting time of 8 to 10 weeks depending on where you buy it!

Given the availability of such useful information, how do we develop and test the right models for forecasting passenger cars? What exogenous and endogenous causal variables should be considered in the model? (do not forget customer facing aspects like choice of color, availability of show cars, salesman’s personality and the woman with the man who showed up to explore).

Do popular planning software offer tools to implement sophisticated models with ease? What tools are available for such ‘Analytics’? How and where do we capture all such customer experience information? What other meaningful correlations and relationships can be derived to establish new cars demand?

E.g.

- Do new home owners tend to buy new cars?

- Whether and to extent is the correlation between price of Gasoline and Car segment preference?

- Whether and to what extent is the correlation between price points and Car segment preference? Within the same brand or another brand ?

- What are the dominant geographical preferences in intention-to-buy? (someone mentioned that it is always a Black or White Scorpio SUV first for a

- particular region in Northern India. Even for a first time car buyer)

- What is the likely market shift to battery powered Cars? Will it cannibalize sales of A segment Cars? Or will both see jump in sales?

- What about tax incentives for Hybrid and battery cars? Is this shift apparent and visible now? Or is this like the Motorcycle Segment?

- Does used car price assurance drive new car sales? What other factors prompt customers to buy new cars more frequently? What is the brand loyalty factor in purchase?

- Do New and Used Cars exhibit similar seasonality? (If US market data is to be believed, then yes)

- Do rebates and freebies bring in commensurate sales?

- What are the various decision drivers involved in the purchase of a new car or the intention to buy surveys?

- What about fleet sales and taxi operators like Ola and Uber? Is there a correlation between sales to this market segment and sales to private individuals ? (hat tip: @Procyon Mukherjee)

Is there a base case for base demand when all the causal variables seem to be at its worst?

E.g. Unemployment, Interest rates, GDP growth, Inflation, Consumer price index, Govt. expenditure, disposable income Quartile, Exchange rates (BTW despite the worst exchange rate in history, SIAM has predicted a 12% growth in Auto Sales in 2018-19. (The credit does not go to usual appropriators of all things good with the economy but to a growing middle class. From 5% to perhaps 6%).